We are moved! Please visit THINK@IBMHK, our new IBM Hong Kong Blog at https://www.ibm.com/blogs/think/hk-en/.

We are moved! Please visit THINK@IBMHK, our new IBM Hong Kong Blog at https://www.ibm.com/blogs/think/hk-en/.

(文章於2018年12月31日在香港經濟日報刊登)

在現代,人口販賣仍是禁之不絕的犯罪活動。根據國際勞工組織 2017 年研究,人口販賣在全球的受害者,每年達 4030 萬人,當中大部分是婦女及兒童。美國國務院報告則指,單在美國本土,每年就有近100萬人遭跨境販賣。

這種踐踏生命的地下買賣,每年全球交易額估計達 11,700 億港元﹝1500億美元﹞,為人販子帶來豐厚利潤,卻對受害者造成巨大的痛苦和傷害。被拐賣者面臨沒機會逃跑的慘況,淪為農奴、家傭或工廠苦工。

(文章於2018年11月29日在香港經濟日報刊登)

消費者通常希望多取得食物的產品資料,了解自己吃的是甚麼。愛吃魚的芬蘭人,現在已能一路追蹤市面上的魚柳,查出魚從哪個湖泊捕來。

芬蘭零售合作社 S-Group 在今夏開始,測試他們的「梭鱸雷達」(Pike-perch radar)方案,提高食物鏈透明度,為客戶由源頭到貨架提供食品的全程路線資料。當地消費者可用「本地白魚柳」包裝上的二維碼,或登錄追蹤網站,追踪一條淡水梭子魚或鱸魚,查出牠的家鄉水域位置。

(文章亦同時被 Unwire Pro引用)

目前的企業趨勢,正邁向由雲端平台提供、具備認知運算能力的基礎設施。企業往往尋求一個平台,能融合局域基礎設施與混合雲,並以安全、高效和透明的方式,結合公共雲與私有雲。

混合雲為甚麼重要?因為大家希望結合機構私有基礎設施與雲端世界,兼取兩者最好的功能。IT 團隊面對的一大挑戰,是如何提高靈活性,從而降低混合雲的使用成本。市場上不少供應商聲稱提供混合雲解決方案,但它們提供的往往只是封閉式產品,或局部性解決方案。

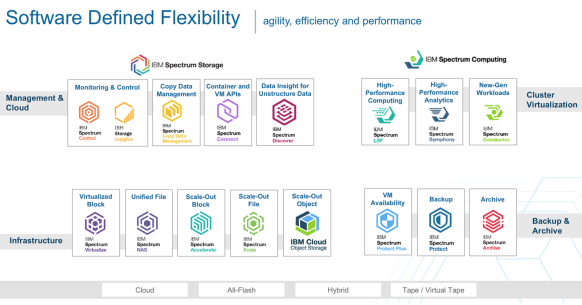

一些軟件定義儲存 (Software Defined Storage) 方案,如 IBM Spectrum Storage,可提供完整的混合雲解決方案,兼容多方供應商。它提供一系列軟件工具,用於管理和優化基礎設施,讓企業能夠將數據放在最方便的位置:本地存儲設備、私有雲,或公共雲。重要的是,它允許移動這些數據,並保持各位置的數據一致,讓應用程式安全存取。

軟件定義儲存有甚麼用途?它允許管理人員透過軟件上的儲存應用程序,優化和管理儲存基礎設施,令儲存區塊、檔案與物件的管理工作,變得相當靈活。管理人員能把任何供應商的設備,安放在本地設施或混合雲中,重點是能夠安全、高效、透明地將它們接駁起來。

(文章亦同時被 Unwire Pro引用)

近期在企業 IT 市場,軟件定義儲存(SDS)處於上升趨勢。不少具前瞻視野的企業,基於節省IT成本、自動化,及令基礎設施更具靈活性的考慮,紛紛採用 SDS。SDS 提供過渡方案,讓企業能從儲存區域網絡(SAN)及網絡接入儲存(NAS),轉型到以伺服器為重心的向外擴容結構。

如果你正在考慮採用 SDS 方案,業界不少IT部門主管通常是從以下的情況,檢視儲存環境的現況:

數據儲存市場的轉型

以前很多 IT 主管相信,採用儲存區域網絡(SAN)作為共享儲存裝置,能克服昔日直連式儲存(DAS)帶來的限制。初期方案多以區塊為基礎的儲存方案配置,後期則配以檔案為基礎的網絡接入儲存(NAS)。

由於企業數據以幾何倍數增長,其中大量屬半結構性或非結構性數據,令企業的存儲要求有增無減。此外,數據儲存的應用也變得更為多元,傳統的供應與消耗模式,已應付不到現有需求。

(文章亦同時被 Unwire Pro引用)

許多機構都有為重要數據安排備份,但為甚麼遭到網絡攻擊時,仍有重要數據遭到清洗?以下是個虛構故事,描寫的卻是企業 IT 人在現代網絡環境中,可能面對的實際情況。

Martin 在一間大型航空公司任職 CIO,公司 IT 服務近年在機構乘客意見調查中取得優秀評價。星期五的工作接近尾聲,當 Martin 準備下班後度周末,他看到來自保安系統的電郵 ── 「高度注意:網絡安全事故」。

(文章亦同時被 Unwire Pro引用)

假設你的機構,制訂了網絡保安事故的應變計劃。計劃是否有效,有沒有遺漏的地方?當機構發生數據外洩或保安事故,會發生甚麼事?很多機構雖然有制訂一些應變措施,但這些計劃甚少經過測試,到真正需要執行時,負責人往往沒有十足的信心和把握。

波耐蒙研究所 (Ponemon Institute) 今年較早時間發表一項有關網絡防衞能力的研究報告,在環球八個國家或地區,訪問二千八百多位從事IT及資訊保安的人士。77%受訪者表示他們的機構,沒有制訂正式的網絡保安事故應變計劃;接近一半受訪者的機構,只有非正式、臨時湊合的應變計劃,甚至沒有任何計劃。

波耐蒙報告又發現,亞太地區受訪者對所屬機構的網絡防衞能力,評分在八個地區排行最低,只有31%。44%亞太被訪者認為網絡保安事故對業務或IT服務,造成「非常頻繁」或「頻繁」的破壞。

(文章於2018年8月23日在香港經濟日報刊登)

身為消費者,如何避免買到含化學毒物的食品、魚目混珠的冒牌皮包、盜竊轉手的贓物,或為內戰國提供軍事經費的鑽石?現代消費品供應鏈很複雜,單靠產品標籤和商戶品牌,難獲百分百保證。但未來數年,區塊鏈將帶來巨大變革。

IBM 商業價值研究院進行區塊鏈研究,訪問 16 國的 203 家消費品生產及零售機構,發現當中 18% 正投放資源籌備區塊鏈,7% 已用於具規模的商業運作。受訪機構認為區塊鏈最能帶來轉變的,是產品安全及防偽。

(文章於2018年8月16日在香港經濟日報刊登)

用內窺鏡和大腸鏡檢查人體內部,始自1880年代,病理學家須接受長期訓練,用顯微鏡和侵入性測試辦別腫瘤。隨城市人口與內科疾病增加,診斷專家日漸吃緊,肉眼有時難免誤診。能否將深度學習 (Deep Learning) 技術用於診斷影像?

深度學習模仿人類腦部神經元互相連結,迅速處理及傳遞訊息。人工神經網絡利用層次、連結和方向傳遞數據,由第一層出發,每層進行不同工序,直到最後一層,數據成為輸出的洞見。分析醫療影像約需100層人工神經網絡。

(原文)

筆者希望借助本文來介紹 Watson Health 的最近發展並消除一些誤解。如果您只是閱讀了近期的某些報導,那麼,您對 Watson Health 的看法,尤其是針對我們的 Watson 腫瘤解決方案 (Watson for Oncology) 產品,可能既不全面也不準確。

三年前,IBM 成立了 Watson Health,目標非常明確:找到人工智能與其他技術的最佳整合方式,協助醫療及健康領域的專業人士應付全球最嚴峻的醫療挑戰。在 Watson Health 所涉及的每一個領域, 我們的努力均已開始產生影響,例如: